When you’re buying term insurance, you’re essentially entering into a long-term promise, one that could last 30, 40, or even 50 years.

The real test of a term insurance policy doesn’t happen when you pay premiums every year. It happens when your family raises a claim, possibly decades later, during one of the most emotionally difficult moments of their lives.

So how do you figure out which insurer will actually honour that promise?

At Ditto, we analyzed IRDAI annual reports, insurers' public disclosures, and long-term performance data to identify companies that have consistently demonstrated strong claim performance, financial stability, and customer-first practices.

Here’s our curated list of the Top 5 Term Insurance Companies in India.

List of the Top 5 Term Insurance Companies

Note: The above rankings are as of 15th January 2026.

How Are the Top 5 Term Insurance Companies Ranked?

To ensure fairness and transparency, Ditto evaluates insurers using objective, measurable parameters that matter at the time of a claim, not marketing promises. Each metric looks at a different aspect of reliability, customer experience, and financial strength.

Below is a detailed explanation of every metric we consider, what’s considered ideal, and which insurer performs best on each parameter.

1) Claim Settlement Ratio (CSR)

- What it means: Claim Settlement Ratio is the percentage of claims an insurer has settled out of the total claims received in a year.

- Why it matters: A higher CSR indicates that the insurer is more likely to honour claims.

- What’s considered good: A CSR above 97% is considered excellent.

- Best performer: Axis Max Life (99.62%)

2) Amount Settlement Ratio (ASR)

- What it means: The Amount Settlement Ratio measures the percentage of the total claim amount paid relative to the total claim amount requested.

- Why it matters: The settlement ratio helps us understand whether an insurer is treating both high- and low-value claims equally. This is because in term life insurance, an insurer either settles the claim entirely or rejects it. There’s no partially paid claim.

- What’s considered good: an ASR above 90% is considered excellent.

- Best performer: Aviva Life Insurance (98.8%)

Note: While Aviva Life Insurance has the highest ASR, it operates on a smaller scale, with fewer claims. Maintaining very high settlement metrics is generally easier at a smaller scale. The real stress test of claim settlement efficiency is among high-volume, high-value insurers, where Axis Max Life emerges as the strongest performer with an ASR of 96.2%.

3) Complaint Volume

- What it means: The number of customer complaints received for every 10,000 claims processed.

- Why it matters: Lower complaint volumes indicate smoother claim processes, better communication, and fewer disputes.

- What’s considered good: Below 5 is considered excellent

- Best performer: HDFC Life (1.33 complaints)

4) Gross Written Premium (GWP)

The GWP reflects financial strength and market trust because larger insurers generally mean greater stability and smoother operations. Since we’re talking about term insurance, GWP is an important determinant of whether an insurer can honor claims decades into the future. Insurers like LIC, SBI, HDFC, and ICICI perform exceptionally well in this regard.

5) Online Services

This metric shows whether you can buy, renew, or service your policy online. This is important because it reduces delays and errors, especially during claims, when speed and clarity are critical. In our experience, all private life insurers have robust systems in place for online offerings.

6) Annual Claims Paid (in crores)

This metric reflects the total value of claims paid by the insurer in a financial year. It’s an important indicator of real-world, scale-based claim handling experience. Insurers paying large claim amounts year after year have proven systems, reserves, and operational maturity.

7) Solvency Ratio

The solvency ratio measures an insurer’s ability to meet its long-term obligations. IRDAI has a minimum requirement of 1.5, and anything above that is considered safe.

How Ditto Uses These Metrics

Looking at any of the above metrics in isolation can be misleading. For example, an insurer might score well in CSR but fail miserably in complaint volumes. That’s why we built a transparent, data-driven system to objectively assess every insurer.

Each insurer is scored on five key measurable parameters, which together form a 10-point Insurer Rating. This is then simplified into a 5-point Ditto Insurer Score for easy comparison.

Ditto’s Rating Formula

Insurer Rating = 20% CSR + 10% ASR + 15% Complaint Volume + 40% GWP + 15% Online Services.

Together, these five factors show who’s financially sound, pays claims reliably, and offers a smooth digital experience. Moreover, these metrics are averaged over the last three years.

This ensures a balanced evaluation, rewarding not just claim ratios, but also scale, consistency, and customer experience.

If you’d like to understand more about our rating methodology, you can do so by checking out our comprehensive guide on the same.

Top 5 Term Insurance Companies' Performance Across Key Metrics?

Note: These metrics are for the life insurance company as a whole (includes other products like ULIPs/savings and annuity plans) and not just the term insurance segment of the business.

Talk to an expert

today and

find

the right

insurance for you.

Top 5 Term Insurance Companies: Detailed Breakdown

Pros:

- Excellent claim handling

- Solid financial strength

- Customer-friendly service

- Competitive pricing

Cons:

- Slightly lower brand recall compared to giants like HDFC Life and SBI Life.

- Smaller network than some legacy players (though still strong and scaling).

Ditto’s Take: Axis Max Life may not always be the loudest brand, but it’s one of the most dependable due to its balanced mix of affordability, service quality, and stability.

Pros:

- Consistently high CSR

- Low complaint volumes

- Large scale and brand trust

- Strong digital capabilities for buying and servicing

Cons:

- Premiums are often higher than those of most competitors

Ditto’s Take: If you’re not going with Axis Max, HDFC Life is the next best option, thanks to its strong brand, low complaints, solid products, and dependable claims.

Pros:

- Good claim performance

- High solvency ratio (Industry best)

- Competitive premiums

Cons:

- The product catalogue can be more distinctive, and the underwriting must remain smooth as the insurer scales

Ditto’s Take: If you want smooth onboarding and dependable servicing, especially as an NRI, Bajaj Life is a great pick. Although it is slightly smaller in scale, it is very consistent. It also has the best solvency numbers in the industry.

Pros:

- Reliable claim performance

- Product flexibility

- Solid online buying experience

Cons:

- Complaint volumes can be slightly higher than most

- While the CSR is dependable, other insurers perform much better.

Ditto’s Take: A reliable, large-scale insurer with strong claims and good product options. Great if you prefer a big, established brand.

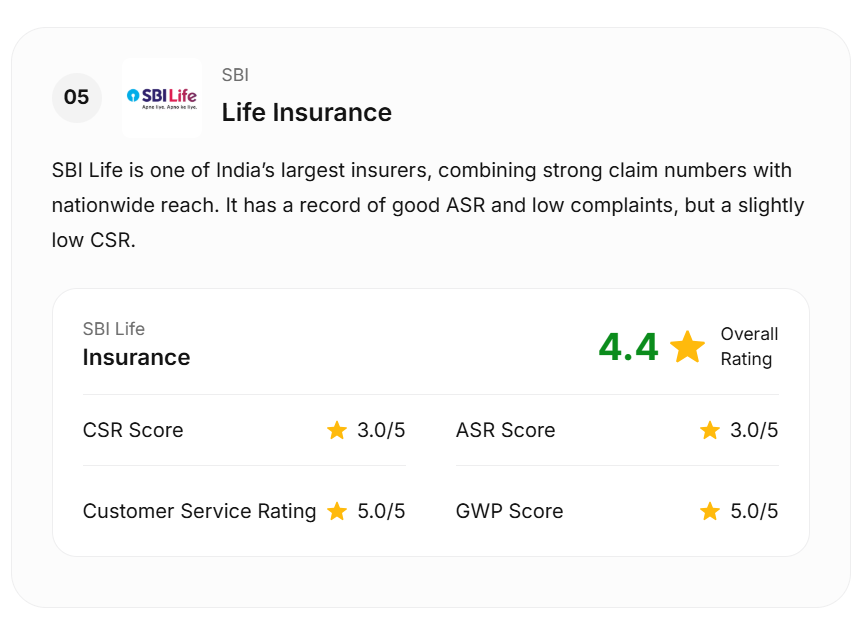

Pros:

- Massive scale and trust

- Strong claims and payouts

- Trusted brand with a huge customer base

Cons:

- Some servicing metrics (such as complaint handling) are not as strong as those of leaders like HDFC Life.

- The plan offerings could be more comprehensive

Ditto’s Take: If you value the comfort of SBI’s legacy and want an insurer with rich and strong claim numbers, this is a good choice. It offers the scale and familiarity of a public-sector brand, with the efficiency of a private insurer.

Note

How to Choose The Best Term Insurance Company?

While rankings help, the best term insurance company for you depends on your personal situation. Here’s what you should prioritise:

- High Claim Settlement & Amount Settlement Ratios: These indicate how reliably claims are honoured.

- Low Complaint Volumes: Fewer complaints usually mean smoother claim and service experiences.

- Strong Solvency Ratio: Shows whether the insurer is financially capable of paying future claims.

- Ease of Claims & Online Support: Digital claim intimation, document uploads, and tracking make a big difference.

- Long-Term Track Record: Insurers with stable performance across decades are generally safer bets.

Why Choose Ditto for Term Insurance?

At Ditto, we’ve assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Aaron below love us:

- No-Spam & No Salesmen

- Rated 4.9/5 on Google Reviews by 15,000+ happy customers

- Backed by Zerodha

- 100% Free Consultation

You can book a FREE consultation. Slots are running out, so make sure you book a call or chat on WhatsApp now!

Conclusion

Term insurance is one of the most important financial decisions you’ll ever make. While premiums matter, what matters far more is whether the insurer will stand by your family when it counts.

The companies listed above have consistently demonstrated strong claim performance, financial stability, and customer-centric practices, making them among the most reliable term insurance providers in India today.

If you’re unsure which one fits your needs, Ditto’s experts are always here to help.

Full Disclosure

Frequently Asked Questions

Last updated on: